doradoweb.online

Gainers & Losers

What Does It Mean When A Phone Is Prepaid

if a product or service is prepaid, it has already been paid for: Each advertisement runs six times and is $ prepaid. Use a prepaid phone card if you're. A rechargeable card enables you to recover credit on a phone card when the amount left is too small to make a call. How Does a Pre-Paid. Phone Card Work? Once. It means that after plan activation, you will be able to make phone calls with a total duration of minutes during the next month. At Lyca Mobile, we believe in giving you the freedom & flexibility to use our services without any contracts and commitments. Therefore, you do not have to sign. A prepaid phone plan provides the basic services of regular cell phones. However, there's no long-term contract requirements or overage charges for minutes that. Card benefits expire after days of last use or 30 days after your service is suspended, whichever occurs first. Keep Your Own Phone (KYOP): Capable device. Prepaid items are paid for in advance, before the time when you would normally pay for them. [ ] See full entry for 'prepaid'. Collins. A pre-paid phone card is a card you purchase (for a set price) and use to make long distance phone calls. These cards are usually sold in dollar amounts or by. Prepaid cell phones, also known as no-contract or pay-as-you-go phones, offer you monthly service without a contract, so you can decide the amount of your. if a product or service is prepaid, it has already been paid for: Each advertisement runs six times and is $ prepaid. Use a prepaid phone card if you're. A rechargeable card enables you to recover credit on a phone card when the amount left is too small to make a call. How Does a Pre-Paid. Phone Card Work? Once. It means that after plan activation, you will be able to make phone calls with a total duration of minutes during the next month. At Lyca Mobile, we believe in giving you the freedom & flexibility to use our services without any contracts and commitments. Therefore, you do not have to sign. A prepaid phone plan provides the basic services of regular cell phones. However, there's no long-term contract requirements or overage charges for minutes that. Card benefits expire after days of last use or 30 days after your service is suspended, whichever occurs first. Keep Your Own Phone (KYOP): Capable device. Prepaid items are paid for in advance, before the time when you would normally pay for them. [ ] See full entry for 'prepaid'. Collins. A pre-paid phone card is a card you purchase (for a set price) and use to make long distance phone calls. These cards are usually sold in dollar amounts or by. Prepaid cell phones, also known as no-contract or pay-as-you-go phones, offer you monthly service without a contract, so you can decide the amount of your.

A prepaid cell phone is one that allows users to pay in advance for their service without the commitment and penalties of a long term contract. Prepaid telephone calls are a popular way of making telephone calls which allow the caller to control spending without making a commitment with the. Burner phones are prepaid phones purchased with cash for privacy reasons, often associated with avoiding authorities. · Burner SIM is a cheap, prepaid SIM card. Service and feature add-ons are always charged the full monthly charge when it is added. Data limit increases during mid-cycle plan changes but does not reset. What's the difference between prepaid and postpaid? The core differences between prepaid and postpaid mobile plans are simple. Prepaid mobile phone plans are. Do you want a no-strings-attached temporary cell phone with an anonymous number? A so-called burner phone may be what you are looking for. Basically a burner. Burners are purchased with prepaid minutes and without a formal contract with a communications provider. While some users may buy burner phones for cash to. Prepaid cell plans are usually monthly rates without a contract. However, sometimes these terms are used interchangeably, since you also "pre-pay" for minutes. The best prepaid phone plans put a hard cap on your monthly cell phone bill so that you always know what the cost will be. With a prepaid plan, you pay in. Prepaid plan (also called “pay-as-you-go”): This is a type of cell phone plan where you pay for your services in advance. You purchase a finite number of. Choose from Prepaid plans for mobile phones, data-only devices, and connected smartwatches. There's no credit check, no deposit, no annual contract. Our current. Prepaid cell plans are usually monthly rates without a contract. However, sometimes these terms are used interchangeably, since you also "pre-pay" for minutes. Prepaid Sim Meaning can be explained easily. Prepaid Sim is the one for which you need to make the payment upfront, before using the service. A prepaid mobile device, also known as a, pay-as-you-go (PAYG), pay-as-you-talk, pay and go, go-phone, prepay or burner phone, is a mobile device such as a. Well they are essentially this, a phone plan that you pay for when you need more credit. Basically once you run out of credit, all you have to do is go down to. Prepaid wireless service, also known as pay-as-you-go, lets you pay in advance for your monthly service charges. There are no annual contracts or credit checks. As its name suggests, a prepaid phone card is a SIM card with a certain amount of prepaid credit loaded onto it. This credit can be used to make calls, send SMS. These credits can be applied towards making phone calls, sending SMS messages or using mobile data. A major advantage of prepaid cards is the absence of credit. Dial on your cell or on any other phone to follow some prompts and refill with a credit, debit, or UScellular refill card. Prefer to pay in. Prepaid cell phones work by allowing users to pay for their service in advance, typically through the purchase of minutes, texts, and data. Instead of signing a.

Best Way To Make A Second Income

Start a blog. Blogging is how I make a living and just a few years ago I never thought it would be possible. I have made over $5,, blogging over the years. Earn extra income by helping other people host an Airbnb space. Similar to Airbnb hosting, but instead of hosting your own space, you help other property owners. 1. Online and In-Person Research Studies: Up to $ an Hour 2. Online Surveys: $1 a Day 3. Find a Virtual Job 4. Make Extra Money Playing Online Games. Passive income can be a great way to generate some extra cash and supplement regular earnings from your job. If you're interested in passive income, stay away. Online surveys, freelance writing, or tutoring might fit your schedule. Good luck! You can almost guarantee that anything you write down can make money somehow. For example, you might like gardening. If you don't mind writing about gardening. Sell items on eBay, Craigslist or Facebook Marketplace. One of the surest ways you can make a little extra money if you're in a bind is to sell items on sites. 4. How can I earn extra income from home? Earning extra money from home can be achieved through part-time remote work, freelancing, or launching a side hustle. Sell items on eBay, Craigslist or Facebook Marketplace. One of the surest ways you can make a little extra money if you're in a bind is to sell items on sites. Start a blog. Blogging is how I make a living and just a few years ago I never thought it would be possible. I have made over $5,, blogging over the years. Earn extra income by helping other people host an Airbnb space. Similar to Airbnb hosting, but instead of hosting your own space, you help other property owners. 1. Online and In-Person Research Studies: Up to $ an Hour 2. Online Surveys: $1 a Day 3. Find a Virtual Job 4. Make Extra Money Playing Online Games. Passive income can be a great way to generate some extra cash and supplement regular earnings from your job. If you're interested in passive income, stay away. Online surveys, freelance writing, or tutoring might fit your schedule. Good luck! You can almost guarantee that anything you write down can make money somehow. For example, you might like gardening. If you don't mind writing about gardening. Sell items on eBay, Craigslist or Facebook Marketplace. One of the surest ways you can make a little extra money if you're in a bind is to sell items on sites. 4. How can I earn extra income from home? Earning extra money from home can be achieved through part-time remote work, freelancing, or launching a side hustle. Sell items on eBay, Craigslist or Facebook Marketplace. One of the surest ways you can make a little extra money if you're in a bind is to sell items on sites.

Tutoring is a great, classic way to make extra money from the comfort of your home. And, it's an ideal side hustle for professionals, because the peak hours. Carsharing or parking spot rentals Don't feel like driving as a rideshare provider? Renting your car is another option to earn passive income. You can host. Here are the best ways to start making money with your car today: Drive That you can earn extra income with your car doesn't mean you necessarily. Become an online tutor and earn extra cash; Provide pet care services such as dog walking and pet sitting; Host with Airbnb and earn an extra income. MoneySavingExpert's huge compendium of 60+ ways to fatten your wallet - try cashback, comping, mystery shopping, renting your driveway & loads more. Start a service business; Invest in real estate; Launch an online resource; Leverage the power of Amazon; Join the sharing economy; Host an event; Get paid to. How to Make Extra Cash through Part-Time Side Income · 1. Cancel Subscriptions You Forgot You Had · 2. Make Money Dog Sitting · 3. Get Paid to. Why not make that kind of help your side job? You can set up your own website advertising your services and use word of mouth to find local customers. Many. Why not make that kind of help your side job? You can set up your own website advertising your services and use word of mouth to find local customers. Many. Relying solely on a traditional job for income might not be the most effective or secure strategy. · Creativity and inspiration are potent tools that can be. Technology has made it simpler to buy and sell items. People looking for second-income ideas in India can start selling products on e-commerce websites. They. If you're good at English and love working with people, tutoring others is a rewarding way to earn extra cash. Preply. A great platform to teach English online. With the majority of Americans spending most of their days in quarantine, CNBC Select outlines five ways you can make extra cash from the comfort of your home. Do you have a way with words and love to write? If so, freelance writing is a simple side hustle. Websites such as Upwork, Flexjobs, Textbroker and Fiverr offer. Side Hustle Ideas to Make Extra Money · 1. Rent out a room or your whole house · 2. Get Paid to Grocery Shop · 3. Become a Proofreader · 4. Be a Virtual Assistant. Join a Focus Group, Test Products and Participate in Research Studies: It is possible to get paid for your opinions. There are many research companies out there. You can make extra income by uploading them to platforms like: Nexus Notes; Notesgen Inc; OneClass; Oxbridge Notes; Course Hero. Photos. “How do I earn. Best ways to earn extra income in South Africa · Freelancing · Online surveys · Selling products online · Tutoring and teaching · Pet-sitting and dog walking. How much can you make: Bloggers make $1, to $, a month. Blogs are one of the most popular ways to make money because they required little upfront costs. You'll instantly feel better once you get your home in order. Not only will you kick out the clutter, you also will earn extra cash doing it. One way is to try.

Types Of Structured Notes

As an example, a rainbow note is a structured product that offers exposure to more than one underlying asset. The lookback product is another popular feature. A structured note combines a Debt Instrument with an option. In its very basic form the discounted value of the coupon is used to buy an option. Structured notes generally fall into one of two broad categories: growth notes and income notes. Equity linked notes (“ELN”) are a type of structured product embedded with derivatives where the returns are linked to the performance of the reference share. One of the most common derivative instruments used in creating structured notes is a swap. For example, we can combine a coupon paying bond with an equity swap. Structured notes are complex financial products that combine different underlying asset classes and may be linked to a specific investment strategy. Unlike. A structured note is a hybrid security that combines multiple payoffs from multiple securities, usually a bond and a derivative. What are Fixed Income Structured Notes? Fixed Income Notes are a type of fixed income investment for investors looking to enhance yield. b. Structured Notes · Equity Linked Notes (ELNs) · Reverse Equity Linked Notes (RELNs) · Fixed Coupon Notes (FCNs) · Bull-bear Notes (BBNs) · Step-Down Auto-Callable. As an example, a rainbow note is a structured product that offers exposure to more than one underlying asset. The lookback product is another popular feature. A structured note combines a Debt Instrument with an option. In its very basic form the discounted value of the coupon is used to buy an option. Structured notes generally fall into one of two broad categories: growth notes and income notes. Equity linked notes (“ELN”) are a type of structured product embedded with derivatives where the returns are linked to the performance of the reference share. One of the most common derivative instruments used in creating structured notes is a swap. For example, we can combine a coupon paying bond with an equity swap. Structured notes are complex financial products that combine different underlying asset classes and may be linked to a specific investment strategy. Unlike. A structured note is a hybrid security that combines multiple payoffs from multiple securities, usually a bond and a derivative. What are Fixed Income Structured Notes? Fixed Income Notes are a type of fixed income investment for investors looking to enhance yield. b. Structured Notes · Equity Linked Notes (ELNs) · Reverse Equity Linked Notes (RELNs) · Fixed Coupon Notes (FCNs) · Bull-bear Notes (BBNs) · Step-Down Auto-Callable.

Structured Notes. Page 2. Categories of Notes. Different types of Notes provide investors with the potential to receive growth or income payments based on the. There are many kinds of structured notes, such as Index-linked GICs for safe returns, Principal Protected Notes to keep your initial investment safe, and. Structured products typically have two components—a note and a derivative (often an option). The note pays interest to the investor at a specified rate and. Financial institutions typically issue structured notes, which are linked to underlying assets such as stocks, stock baskets, market indices or financial. These include (but are not limited to): Income Notes, Growth Notes, Principal Protected Notes (PPN), Absolute Notes, and Digital Notes. Market Linked Note – A type of Structured Investment where the Principal Amount is invested in a debt obligation of the Issuer, with returns linked to the. Structured notes are hybrid investment products, with a predetermined maturity date, created by combining various financial instruments, shaping a unique and. Structured notes linked primarily to well-known indices, and to equities, commodities and interest rates that are offered directly to institutional investors. Structured product · Interest rate-linked notes and deposits · Equity-linked notes and deposits · Exchange-traded note · FX and commodity-linked notes and deposits. There are many types of structured notes like Principal Protected Notes, Yield Enhancement Notes, and Market-Linked GICs. A structured note with principal protection is a structured investment product that combines a bond with a derivative component and that offers a full or. 04 State of the Structured Notes Market. 05 Structured Notes Types and Characteristics. 06 Market-Linked Growth Notes. 07 Market-Linked Income Notes. 09 Market. Types Of Structured Notes · Return may be linked to a single share, or a basket of shares, or to an equity index (for example, the S&P ) or a basket of. There are many kinds of structured notes, such as Index-linked GICs for safe returns, Principal Protected Notes to keep your initial investment safe, and. As this definition suggests, there are multiple types of structured products. o Different from Traditional Fixed Rate Bonds: Structured notes and other. At the inception of the structured product market, capital protected notes were the most popular product type. They were attractive because of the simple. These types of provisions could allow the debt obligations of a bank, including its structured notes and warrants, to be restructured, written-down or. Structured Investments, including your initial investment. How can you use Structured Investments in your portfolio? Depending on the specific type of note. The retail market for structured notes with principal protection has been growing in recent years. While these products often have reassuring names that.

Fib Stock

Historical stock prices. Current Share Price, лв 52 Week High, лв 52 Week Low, лв Beta, 11 Month Change, %. 3 Month Change, %. When a stock makes a high and a low, connecting the two points up and back down produces a set a of fib retracement levels in both directions. There is much. The CB First Investment Bank AD stock price today is What Is the Stock Symbol for CB First Investment Bank AD? The stock ticker symbol for CB First. Fibonacci projections are used by traders in forex, stocks, commodities, and other financial markets to make informed investment decisions. The key levels. The tool can be used across many different asset classes, such as foreign exchange, shares, commodities and indices. Join a trading community committed to your. Fibonacci retracement levels are horizontal lines that indicate the possible locations of support and resistance levels. Each level is associated with one of. Complete First Investment Bank AD stock information by Barron's. View real-time FIB stock price and news, along with industry-best analysis. First Investment Bank AD (FIB.): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock First Investment Bank AD | Bulgaria S.E. Fibonacci retracement levels are prices, depicted as horizontal lines on a chart, that indicate where support or resistance could likely to occur. Historical stock prices. Current Share Price, лв 52 Week High, лв 52 Week Low, лв Beta, 11 Month Change, %. 3 Month Change, %. When a stock makes a high and a low, connecting the two points up and back down produces a set a of fib retracement levels in both directions. There is much. The CB First Investment Bank AD stock price today is What Is the Stock Symbol for CB First Investment Bank AD? The stock ticker symbol for CB First. Fibonacci projections are used by traders in forex, stocks, commodities, and other financial markets to make informed investment decisions. The key levels. The tool can be used across many different asset classes, such as foreign exchange, shares, commodities and indices. Join a trading community committed to your. Fibonacci retracement levels are horizontal lines that indicate the possible locations of support and resistance levels. Each level is associated with one of. Complete First Investment Bank AD stock information by Barron's. View real-time FIB stock price and news, along with industry-best analysis. First Investment Bank AD (FIB.): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock First Investment Bank AD | Bulgaria S.E. Fibonacci retracement levels are prices, depicted as horizontal lines on a chart, that indicate where support or resistance could likely to occur.

Get First Investment Bank AD (doradoweb.online) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Your premium tools, data and news, to unlock hidden investment opportunities. Features. ProPicks AI New; Stocks Ideas. I've seen Fibonacci retracements called clones, which is essentially the same thing with different percent retracements, the simplest being Contacts. Phone: Email: [email protected] Address: Crawford Business Park, State House Rd,Nairobi Kenya. Market Insights. Corporate Actions · Open. Key statistics. On Tuesday, First Investment Bank AD (FIB:BLG) closed at , % below its week high of , set on Aug 14, Data delayed at. For more information on First Interstate BancSystem, Inc., please contact our Investor Relations team. · [email protected] Transfer. Get real-time CB First Investment Bank AD (FIB) stock price quotes, analyst insights, forecasts, news, and information you need to help your stock trading. First Interstate BancSystem, Inc. is a financial services holding company headquartered in Billings, Montana. It is the parent company of First Interstate Bank. Get the latest First Investment Bank AD (BUL: FIB) stock price quote with financials, statistics, dividends, charts and more. Fibonacci Levels Stock Screener has many customizable criteria and runs on stock and cryptocurrency world exchanges. Develop a sophisticated Fibonacci. View the latest First Investment Bank AD (FIB) stock price, news, historical charts, analyst ratings and financial information from WSJ. Find the latest First Interstate BancSystem, Inc. (FIBK) stock quote, history, news and other vital information to help you with your stock trading and. Research First Investment Bank AD's (BUL:FIB) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance. Fibonacci retracement is a technical analysis term referring to support or resistance areas that is used by both active and long-term traders. Fibonacci projections are used by traders in forex, stocks, commodities, and other financial markets to make informed investment decisions. The key levels. Fibonacci ratios can help technical traders identify areas of support, resistance, and retracement. When a stock moves off its peak or trough levels, traders. Get doradoweb.online stock quote information for First-Investment-Bank-AD, including a stock overview, one-click scorecard, industry position, and the latest. Fibonacci is very powerful. Traders never forget to check Fibonacci retracement chart before any swing trade. This app is a handy tool to quickly draw the. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. In finance, Fibonacci retracement is a method of technical analysis for determining support and resistance levels.

How To Avoid Rmd

7 Well-Known Ways to Sidestep the RMD · Withdraw more earlier: If you draw down your retirement plan balances before you're 72, your RMDs will be lower. Surgent's Top 20 Effective Strategies for Avoiding RMD Mistakes and Penalties: Updated for the Proposed RMD Regulations, SECURE Act (2 hou ; Designed For. Your RMD is based, in part, on your account balances. With smaller account balances, you should have smaller RMDs. One way to reduce your account balances is to. Simply, the only way to avoid tax penalties is to adhere to federal law and ensure you're withdrawing the correct RMD amount from the correct retirement. – After totaling up your calculated RMDs from each of your (b)s, you can take the total RMD you owe from any combination of (b) accounts. If you continue to work past age 73 and do not own more than 5% of the business you work for, most plans allow you to postpone RMDs from your current—but not a. Simply, the only way to avoid tax penalties is to adhere to federal law and ensure you're withdrawing the correct RMD amount from the correct retirement. Required minimum distributions (RMD) must begin for the year in which the account owner reaches age 72, unless an exception applies. RMDs must also be taken. Can I donate my RMD to charity and avoid the taxes? Yes. A qualified charitable distribution (QCD) is not subject to ordinary federal income taxes – the. 7 Well-Known Ways to Sidestep the RMD · Withdraw more earlier: If you draw down your retirement plan balances before you're 72, your RMDs will be lower. Surgent's Top 20 Effective Strategies for Avoiding RMD Mistakes and Penalties: Updated for the Proposed RMD Regulations, SECURE Act (2 hou ; Designed For. Your RMD is based, in part, on your account balances. With smaller account balances, you should have smaller RMDs. One way to reduce your account balances is to. Simply, the only way to avoid tax penalties is to adhere to federal law and ensure you're withdrawing the correct RMD amount from the correct retirement. – After totaling up your calculated RMDs from each of your (b)s, you can take the total RMD you owe from any combination of (b) accounts. If you continue to work past age 73 and do not own more than 5% of the business you work for, most plans allow you to postpone RMDs from your current—but not a. Simply, the only way to avoid tax penalties is to adhere to federal law and ensure you're withdrawing the correct RMD amount from the correct retirement. Required minimum distributions (RMD) must begin for the year in which the account owner reaches age 72, unless an exception applies. RMDs must also be taken. Can I donate my RMD to charity and avoid the taxes? Yes. A qualified charitable distribution (QCD) is not subject to ordinary federal income taxes – the.

Another solution to avoid RMDs would be to convert traditional IRA money to a Roth IRA. You will owe tax on the conversion at your ordinary income tax rate. But. Payouts and capital growth from Roth IRA plans are tax-free and can be inherited free of inheritance tax. There are also no RMDs for Roth IRAs. “Roth. Distributions from Roth IRAs do not satisfy RMD requirements and Roth IRA owners have no RMD due. You cannot aggregate RMDs from all of your QRPs. You have to. How can I reduce future RMDs? · Convert assets to a Roth account: While taxes will apply on the converted amount, RMDs will not be required in the future. · If. It's called a required minimum distribution (RMD), and savers who have money stashed away in an IRA or qualified retirement account (a (k), (b), etc.). How To Take RMDs To Avoid Taxes · Withdraw Early: The idea behind early withdrawals is to reduce the balance in your retirement accounts before RMDs kick in. There's no way to avoid or delay RMDs. After the RMD is taken, you can convert some amount to Roth, which would incur current taxes, but future. RMDs ensure that individuals don't benefit from tax-deferred growth for too long—and can help prevent people from using their tax-deferred retirement accounts. So you avoid the tax on RMDs down the road, and you avoid taxes on all future growth in the value of your plan assets, but you will owe. Another strategy to avoid RMDs is to roll over some of your savings into a Roth IRA, which doesn't include any RMD mandates over the span of your lifetime. How To Take RMDs To Avoid Taxes · Withdraw Early: The idea behind early withdrawals is to reduce the balance in your retirement accounts before RMDs kick in. Owners of a traditional individual retirement account (IRA) or tax-deferred retirement account must take required minimum distributions (RMDs) beginning at age. Required minimum distributions (RMD) must begin for the year in which the account owner reaches age 72 unless an exception applies. RMDs must also be taken from. In most situations, it's advisable to take your first RMD at age 73 to avoid higher taxes in the year when your income is higher. However, in rare cases where. Another strategy to avoid RMDs is to roll over some of your savings into a Roth IRA, which doesn't include any RMD mandates over the span of your lifetime. What are RMDs? · Roth IRAs* · Your very first RMD, which you can delay until April 1 of the following year, but which would require you to take two RMDs that year. Understand your options, the rules to follow and penalties to avoid when taking required minimum distributions. If you have a (k) or traditional IRA, you'. To ensure that tax liabilities aren't deferred indefinitely, investors are obligated by the IRS to take required minimum distributions (RMDs) from most. Surgent's Top 20 Effective Strategies for Avoiding RMD Mistakes and Penalties: Updated for the Proposed RMD Regulations, SECURE Act ; Prerequisites. None.

House Movers Singapore

A wide range of professional moving services: Superior Movers remain the people's first choice whenever there is a comprehensive moving need. Their services. In this article, we will explore some of the premier residential moving services in Singapore, their individual offerings, and what makes them stand out. Vimbox – Reliable House Movers in Singapore Vimbox Movers Singapore. We are an award-winning house moving and storage company for residential and business. LS House Movers Singapore, Singapore. likes. We provide moving and storage service in Singapore for commercial and residential. We are known as head house and office mover due to our extra cautious regard for moving subtlety. We have an extraordinary service unwavering quality and to. Address: 2 Defu Lane 10 # Singapore Phone: Email: [email protected] Stay In Touch: We are happy to provide any assistance. Moved from a large studio to a 2 room BTO cross island. I got a huge covered foot lorry and 2 movers for $ Our house and commercial mover rates are designed to cater to a range of needs, from basic packages to more comprehensive solutions. We are one of the most experience moving company in Singapore. House moving, office relocations, furniture moving and other any type of related moving services. A wide range of professional moving services: Superior Movers remain the people's first choice whenever there is a comprehensive moving need. Their services. In this article, we will explore some of the premier residential moving services in Singapore, their individual offerings, and what makes them stand out. Vimbox – Reliable House Movers in Singapore Vimbox Movers Singapore. We are an award-winning house moving and storage company for residential and business. LS House Movers Singapore, Singapore. likes. We provide moving and storage service in Singapore for commercial and residential. We are known as head house and office mover due to our extra cautious regard for moving subtlety. We have an extraordinary service unwavering quality and to. Address: 2 Defu Lane 10 # Singapore Phone: Email: [email protected] Stay In Touch: We are happy to provide any assistance. Moved from a large studio to a 2 room BTO cross island. I got a huge covered foot lorry and 2 movers for $ Our house and commercial mover rates are designed to cater to a range of needs, from basic packages to more comprehensive solutions. We are one of the most experience moving company in Singapore. House moving, office relocations, furniture moving and other any type of related moving services.

At Allied we know that moving house can be a chore. From packing boxes to cleaning your old house and settling into your new home, it can easily take a month to. Cube Movers Singapore; Rodex Movers Singapore; M&P International Freights Pte. Ltd. Peace Moving Services; Tip Top Movers; SMART Relocators; We Moving Services. Zealous Mover is a residential mover and home mover in Singapore that is considered one of the best in the country. Contact us to find out more. Vincent Movers makes your house moving experience a pleasant one. When you engage our packing services, packing materials such as bubble wrap, newspaper. Vimbox is a trustworthy house moving company in Singapore. We provide house moving services coupled with different packages to meet different needs of our. Your trusted Home & Office Movers with more than 20 years experience. We offer on site quotations & easy moving experience. Call + Today! We've rounded up the top 5 cheap house moving companies to entrust your worldly goods to. Prices per foot truck start from $ As a premier house movers Singapore, Red Sun Movers, specialises in making your relocation experience seamless and stress-free. Whether you are moving across. House Mover Singapore As a full service house mover in Singapore. Need a quote for your next house moving? Contact Superior Movers +65 Singapore. Top Singapore Movers. Professional movers in Singapore for anytime moving services. NO Hidden Fees. FREE carton boxes. Fast, Safe & % Reliable Mover! Shalom Movers voted as best moving company with best value in house moving services House Movers In Singapore. 3 Key Challenges of Every Customer. Incidental. Nimbus Homes provides professional moving services to make your relocation easier. Our experienced team carefully handles things of all sizes. In conclusion, our professional house moving services in Singapore are designed to cater to the diverse needs of homeowners across different property types. Reliable house movers in Singapore offering comprehensive services at affordable pricing. Choose 12Move for a stress-free, seamless relocation experience. JC Movers is the one-stop company for hassle-free residential moving services in Singapore. Ease your next move with our professional house movers. Reliable movers service trusted by thousands of people in Singapore. What are you moving? Door-to-Door delivery. Same Day service. Fixed Prices. The general price of home moving and delivery services in Singapore ranges from $ to $ per 14ft car lift. Looking for a reliable best house movers Singapore? Look no further than the highly skilled and experienced team at Fortuna Hu Mover! We help you in reducing the stress associated with relocating as one of Singapore's top movers. We have been in operation for more than ten years and have only. XM Movers offers a range of packages to cater to different moving needs, from basic moves to complete pack, move, and unpack services.

Grants For Minority Women To Start A Business

Eligibility · Linked deposits, minority and women revolving loan trust fund · Contractor development assistance · Business development loans, franchise loans · Loan. New Voices Fund. The New Voices Fund grants capital and expert advice to women of color who wish to start a business, grow their current business or set up a. The US Small Business Administration's 8(a) Business Development Program helps minority owned businesses to grow and develop their business. We have tracked over funding programs and $1,,, allocated for Women in Business. · Inside doradoweb.online Applicants Portal · Grant application guides. WomensNet began the grant, which distributes $1, monthly grants to women with a range of small business ideas. The recipients who gain a $1, grant are. Federal grants: These grants are provided by the government and can include programs such as the Small Business Administration (SBA) grants and the Minority. 1. The Amber Grant · 2. SoGal's Black Founder Startup Grant · 3. NBMBAA® Scale-Up Pitch Challenge · 4. iFundWomen · 5. NASE Growth Grants · 6. Minority Business. Fearless Strivers grant contest. The Fearless Fund invests in women of color-led businesses and holds a contest specifically for black women-owned businesses. The SoGal Foundation, in partnership with companies such as Bluemercury, Twilio, and others, offers startup grants to businesses owned by Black women or Black. Eligibility · Linked deposits, minority and women revolving loan trust fund · Contractor development assistance · Business development loans, franchise loans · Loan. New Voices Fund. The New Voices Fund grants capital and expert advice to women of color who wish to start a business, grow their current business or set up a. The US Small Business Administration's 8(a) Business Development Program helps minority owned businesses to grow and develop their business. We have tracked over funding programs and $1,,, allocated for Women in Business. · Inside doradoweb.online Applicants Portal · Grant application guides. WomensNet began the grant, which distributes $1, monthly grants to women with a range of small business ideas. The recipients who gain a $1, grant are. Federal grants: These grants are provided by the government and can include programs such as the Small Business Administration (SBA) grants and the Minority. 1. The Amber Grant · 2. SoGal's Black Founder Startup Grant · 3. NBMBAA® Scale-Up Pitch Challenge · 4. iFundWomen · 5. NASE Growth Grants · 6. Minority Business. Fearless Strivers grant contest. The Fearless Fund invests in women of color-led businesses and holds a contest specifically for black women-owned businesses. The SoGal Foundation, in partnership with companies such as Bluemercury, Twilio, and others, offers startup grants to businesses owned by Black women or Black.

The Eileen Fisher Women-Owned Business Grant focuses on giving women entrepreneurs the resources they need to help solve this issue. Recently, this grant. IFundWomen is a funding platform for women entrepreneurs that provides access to capital via crowdfunding and business grants. They offer a variety of grants. If the MWBE is interested in developing their own organizational capacity, the MWBE can apply for MassCEC's Equity Workforce Capacity Grants, which are funding. Private Small Business Grants for Women · Amber Grant · IFundWomen Grant · Women Founders Network Fast Pitch Competition · NASE Growth Grant · Freed Fellowship Grant. The EnrichHER small business grant will help your business get the funding you need. This program gives eligible entrepreneurs — especially women and people of. If the MWBE is interested in developing their own organizational capacity, the MWBE can apply for MassCEC's Equity Workforce Capacity Grants, which are funding. “Every month, WomensNet awards three $10, Amber Grants to women-owned businesses. At the end of each year, monthly grant winners are eligible to receive one. Invest Atlanta provides gap financing through various loan programs to small, minority and female-owned businesses to expand and/or relocate in the city of. minority and women-owned businesses start-up and grow in Texas. Additional Business Resources. SBA Office of Women's Business Ownership · SCORE Business. For this reason, I have created this guidebook to serve as a starting point in providing information from relevant federal and state agencies about what. The program's objective is to provide ongoing, quality assistance to minority businesses with rapid growth potential so that they can achieve greater. Creditworthy small businesses in New Jersey may be eligible for assistance under the Small Business Fund. Minority-owned or women-owned businesses may qualify. First thing to remember is that minorities are eligible for any business grant or contract. Some of these programs may have “set-asides” that. The MWBE Fund invested in six seed-stage certified minority and women-owned business enterprises (MWBEs). Excell Partners was competitively selected to manage. Minority women are encouraged to apply for the Walter Grant Award. This program provides $2, grants to promising diverse writers and illustrators with. The Minority Business Enterprise (MBE) Loan Program provides loans to socially and economically disadvantaged minority- and women-owned businesses as designated. The Minority Business Enterprise (MBE) Loan Program provides loans to socially and economically disadvantaged minority- and women-owned businesses as designated. Free grants or loans during calendar year can be issued to small or medium businesses and some lenders (or government programs) may even help minority or. “This organization offers monthly grants of up to $10, to support female entrepreneurs starting businesses. Those who qualify for these grants are also in.

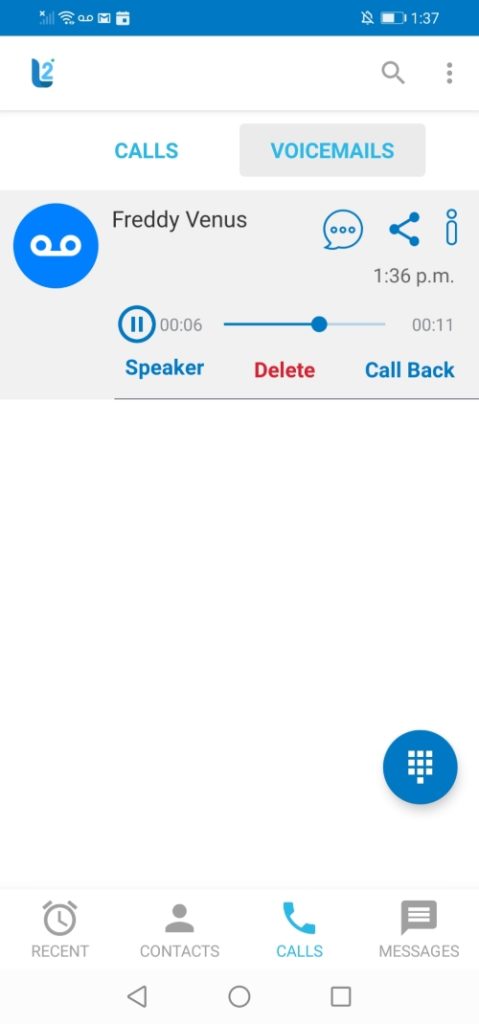

Best Voip For Ios

10 Best VoIP Apps for iPhone · 1. CallHippo · 2. RingCentral · 3. Nextiva · 4. Dialpad · 5. OpenPhone · 6. Skype · 7. Vonage · 8. Grasshopper. The best VoIP app for both iPhone and Android is NUACOM. It offers a seamless experience across both platforms, ensuring that users can enjoy. Here's a list of the top 10 best iPhone apps that let you make free VoIP calls: · 1. Fring · 2. iCall · 3. JaJah · 4. nimbuzz · 5. MO-Call · 6. Skype · 7. App Reviews» VOIP · Skype for iPad · fone pro · Viber – Free Phone Calls · Google Voice · Skype · Fring · VoiceCentral Black Swan · iCall. International calls and SMS at great rates. · Great benefits: pay per minute, no hidden fees. · Enjoy high quality VoIP calls all around the world & a friendly. Dialpad is our top pick when it comes to the best VoIP software category, we can't exactly recommend it when customers being asking us deeply about integration. iPhone VoIP Applications · Aircall · Dialpad · 8x8 Contact Center · doradoweb.online · Cytracom · ULTATEL Cloud Business Phone System · Intulse · JustCall. Made to work with your POS. The Free Voicee iOS App is designed to work on your POS hardware. Simply “slide over” the Voicee App over your POS, connect a. One of the best VoIP apps for both Android and iPhone is EasyVoIP Connect. It offers a range of features ideal for business communication. 10 Best VoIP Apps for iPhone · 1. CallHippo · 2. RingCentral · 3. Nextiva · 4. Dialpad · 5. OpenPhone · 6. Skype · 7. Vonage · 8. Grasshopper. The best VoIP app for both iPhone and Android is NUACOM. It offers a seamless experience across both platforms, ensuring that users can enjoy. Here's a list of the top 10 best iPhone apps that let you make free VoIP calls: · 1. Fring · 2. iCall · 3. JaJah · 4. nimbuzz · 5. MO-Call · 6. Skype · 7. App Reviews» VOIP · Skype for iPad · fone pro · Viber – Free Phone Calls · Google Voice · Skype · Fring · VoiceCentral Black Swan · iCall. International calls and SMS at great rates. · Great benefits: pay per minute, no hidden fees. · Enjoy high quality VoIP calls all around the world & a friendly. Dialpad is our top pick when it comes to the best VoIP software category, we can't exactly recommend it when customers being asking us deeply about integration. iPhone VoIP Applications · Aircall · Dialpad · 8x8 Contact Center · doradoweb.online · Cytracom · ULTATEL Cloud Business Phone System · Intulse · JustCall. Made to work with your POS. The Free Voicee iOS App is designed to work on your POS hardware. Simply “slide over” the Voicee App over your POS, connect a. One of the best VoIP apps for both Android and iPhone is EasyVoIP Connect. It offers a range of features ideal for business communication.

Acrobits Groundwire is our preferred VoIP phone app for business applications. It is available for iPhone and Android at a one off cost of around $ Cheap Voip Calls: The Mobile VOIP dialer lets you make cheap national or international calls. MobileVOIP is the best Android voip solution;. MizuPhone for iOS is a simple to use SIP softphone for iPhone, iPod and iPad devices with the best possible call quality and reliability. Top 10 Mobile VoIP Service Providers · Vonage Mobile VoIP Service Provider · AT&T Business VoIP Mobile Service Provider · Grasshopper Mobile VoIP Service Provider. Viber · Vonage · Moon Dialer: VoIP Calling App · FaceTime · Vonage · Line2. Best VoIP Apps for iPhone And Android Mobile Phones: 1. Grasshopper 2. Nextiva 3. Bitrix24 4. JustCall 5. RingCentral 6. Fresh Caller 7. Pinger 8. Vonage 9. Best VoIP Apps for iPhone · Aircall · doradoweb.online · Dialpad · ULTATEL Cloud Business Phone System · Vonix · Zoho Voice · Cytracom · Intulse. . Try Zoom Phone for a VoIP phone system with unlimited domestic calls, SMS messaging, voicemail transcription, call recording, and seamless app integrations. Linphone is an open source SIP client for HD voice/video calls, 1-to-1 and group instant messaging, conference calls etc. Available for iOS, Android. iOS Apps for Web Phones & VoIP Software · VoxOx Call · Phoner · Adore TwinDialer · FreeRange Mobile · PrivateGSM VOIP Professional for iPhone · Video Date · QuadCom. The best VoIP apps offer high-quality calls, a variety of features, and a user-friendly interface. Here are some of the best apps for VoIP calls on iPhone. I am looking for recommendations for the best voip apps to try on GrapheneOS. good experiences (by softphone standards) on both stock Android and iOS. Starting at $ per month with an annual plan, AXvoice is one of the best bang-for-your-buck residential VoIP providers we've encountered. The service bundles. Zoiper, the free softphone to make VoIP calls through your PBX or favorite SIP provider. Available for iPhone, Android, Windows Phone 8, Windows. The Best VoIP Apps of · RingCentral: Best for unified communication (UC) · Dialpad: Best for artificial intelligence (AI)-powered insights · Nextiva: Best for. VirtualPBX Business VoIP is a premier solution in the cloud communications industry, designed to meet the needs of businesses of all sizes. With over 27 years. A reliable, secure VoIP phone service trusted by more than businesses. Learn why RingCentral may be the best VoIP provider for you. Best VoIP Apps for iPhone · Aircall · doradoweb.online · Dialpad · ULTATEL Cloud Business Phone System · Vonix · Zoho Voice · Cytracom · Intulse. . Like Skype, you can use this service to place free VoIP calls to other Viber users. You can also call non-Viber users for a low fee, which is usually less than.

First Time Home Purchase Ira

Roth IRA early withdrawal penalty and converted amounts · Use the distribution for a first-time home purchase — up to a $10, lifetime limit · You're totally. If your employer and the plan permit, first-time buyers can take advantage of the hardship rule of early IRA withdrawal. If you qualify, you won't have to pay. You can take penalty-free IRA distributions of up to $10, over your lifetime to buy your primary residence, but there are certain factors you need to. You make withdrawals for a qualified first-time home purchase (lifetime limit of $10,);; You make withdrawals to pay qualified higher education expenses. If you qualify as a first-time homebuyer, you can withdraw up to $10, from your traditional IRA and use the money to buy, build, or rebuild a home. With a. Anne, age 30 and unmarried, wants to purchase her first home. She enters into a contract to buy a house. Anne can withdrawal up to $10, from her IRA to. First-time homebuyers may withdraw up to $ from their Individual Retirement Accounts to fund a home purchase. Here are some factors to consider before. Your IRA savings is always yours when you need it—whether for retirement or emergency funds. Before you withdraw, we'll help you understand below how your. Homebuyers, qualified first-time homebuyers, up to $10,, no, yes, 72(t)(2)(F). Levy, because of an IRS levy of the plan, yes, yes, 72(t)(2)(A)(vii). Medical. Roth IRA early withdrawal penalty and converted amounts · Use the distribution for a first-time home purchase — up to a $10, lifetime limit · You're totally. If your employer and the plan permit, first-time buyers can take advantage of the hardship rule of early IRA withdrawal. If you qualify, you won't have to pay. You can take penalty-free IRA distributions of up to $10, over your lifetime to buy your primary residence, but there are certain factors you need to. You make withdrawals for a qualified first-time home purchase (lifetime limit of $10,);; You make withdrawals to pay qualified higher education expenses. If you qualify as a first-time homebuyer, you can withdraw up to $10, from your traditional IRA and use the money to buy, build, or rebuild a home. With a. Anne, age 30 and unmarried, wants to purchase her first home. She enters into a contract to buy a house. Anne can withdrawal up to $10, from her IRA to. First-time homebuyers may withdraw up to $ from their Individual Retirement Accounts to fund a home purchase. Here are some factors to consider before. Your IRA savings is always yours when you need it—whether for retirement or emergency funds. Before you withdraw, we'll help you understand below how your. Homebuyers, qualified first-time homebuyers, up to $10,, no, yes, 72(t)(2)(F). Levy, because of an IRS levy of the plan, yes, yes, 72(t)(2)(A)(vii). Medical.

Yes, you can use your IRA to buy your first home by taking a penalty-free withdrawal of up to $10, for a down payment, though income taxes will still apply. Withdrawals from a Roth IRA you've had less than five years. · You use the withdrawal (up to a $10, lifetime maximum) to pay for a first-time home purchase. Each taxpayer who qualifies as a "First-Time Home Buyer" can make a $ penalty-free withdrawal from an IRA to purchase a home. (Please note tha. Five tax years after the first contribution, you can withdraw up to $10, of your earnings penalty-free to pay for qualified first-time home buyer expenses. You can withdraw your own contributions to a Roth IRA at any time with no taxes or penalties. It's only growth that would incur a penalty. Qualified first-time buyers can withdraw up to $10, from their IRA penalty free to buy, build or rebuild a first home. You must close on the transaction. Can you borrow from an IRA? · For a qualified first-time homebuyer distribution (up to $10,; in line with federal tax laws) · For qualified higher education. If you qualify as a first-time home buyer, you can withdraw up to $10, from your IRA to use as a down payment (or to help build a home) without having to pay. First-time homebuyer's exemption from IRS penalty tax. Up to $10, can be withdrawn from a traditional IRA for first-time homebuyer expenses without incurring. While this exception allows first time home buyers to avoid the 10% penalty, the withdrawal would still be charged income tax. By comparison, if you wanted to. Roth IRA · A first-time home purchase (up to $10,) · A birth or adoption expense (up to $5,) · A qualified education expense · A death, disability or terminal. Withdrawals from a Roth IRA you've had less than five years. · You use the withdrawal (up to a $10, lifetime maximum) to pay for a first-time home purchase. If you are buying, building, or re-building your first home (defined later), you are allowed to take a distribution of up to $10, (or $20, for a married. The IRA owner is totally and permanently disabled. The IRA owner is using the withdrawal for a first-time home purchase ($10, lifetime limit). The. First time home purchase Up to $10, of your distribution may be penalty-free if used to buy, build or rebuild your first home. There is a lifetime limit of. If you are a first-time homebuyer, you may qualify for a tax exemption on your IRA withdrawals. You can withdraw a maximum of $10, from your IRA to build or. First-Time Homebuyer Provision: Utilize the first-time homebuyer provision to withdraw up to $10, penalty-free from your IRA for a home purchase if you. The IRS allows first-time homebuyers to withdraw not only their Roth IRA contributions but also up to $10, of earnings without any early withdrawal penalty. Age 59½ and under: Early IRA withdrawal penalties—with some exceptions · First-time home purchase. Some types of home purchases are eligible. · Educational. Keep in mind that you can take money out of your IRA at any time if you're Buying, building, or rebuilding your own home for the first time (“first.

Turbotax Free Vs Plus

Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or. Everything in Free plus: Homeowner deductions. Childcare expenses. Health Price Tag 28% less than TurboTax. Start for Free. Premier. Everything in. TurboTax Free Edition: TurboTax Free Edition ($0 Federal + $0 State + $0 To File) is available for those filing Form and limited credits only, as detailed. 33 reviews. Save with. Walmart Plus. Shipping, arrives in 2 days. Options TurboTax Basic Fed Windows or Mac CD & Download. Free shipping, arrives. TurboTax Free Edition (and TurboTax Live Basic) are intended for taxpayers who file Form with limited credits. Roughly 37% of taxpayers qualify. 33 reviews. Save with. Walmart Plus. Shipping, arrives in 2 days TurboTax Deluxe Tax Software - Federal & State Tax Return - Download BONUS FREE Dr. +. TURBOTAX ONLINE/MOBILE PRICING. Start for Free/Pay When You File: TurboTax online and mobile pricing is based on your tax situation and varies by product. However, H&R Block Free Online includes more tax forms than the TurboTax Free Edition, meaning people can file more situations for free with H&R Block Online. In the on-line version, there is The Free Edition if you meet the requirements. Other than that, there is Basic, Deluxe, Premier and Self-. Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or. Everything in Free plus: Homeowner deductions. Childcare expenses. Health Price Tag 28% less than TurboTax. Start for Free. Premier. Everything in. TurboTax Free Edition: TurboTax Free Edition ($0 Federal + $0 State + $0 To File) is available for those filing Form and limited credits only, as detailed. 33 reviews. Save with. Walmart Plus. Shipping, arrives in 2 days. Options TurboTax Basic Fed Windows or Mac CD & Download. Free shipping, arrives. TurboTax Free Edition (and TurboTax Live Basic) are intended for taxpayers who file Form with limited credits. Roughly 37% of taxpayers qualify. 33 reviews. Save with. Walmart Plus. Shipping, arrives in 2 days TurboTax Deluxe Tax Software - Federal & State Tax Return - Download BONUS FREE Dr. +. TURBOTAX ONLINE/MOBILE PRICING. Start for Free/Pay When You File: TurboTax online and mobile pricing is based on your tax situation and varies by product. However, H&R Block Free Online includes more tax forms than the TurboTax Free Edition, meaning people can file more situations for free with H&R Block Online. In the on-line version, there is The Free Edition if you meet the requirements. Other than that, there is Basic, Deluxe, Premier and Self-.

We've got you with TurboTax Live Full Service. mobile-A-r-vs-FS-EN refund the applicable TurboTax Live Full Service purchase price paid. If you. With Intuit TurboTax, you can file your simple Federal and State taxes for free. Plus, your tax return will be reviewed by an expert, also for free! Freetaxusa is a lot better to be honest. You get everything you get in the $ version of Turbotax for like $20 I think. TURBOTAX ONLINE/MOBILE PRICING. Start for Free/Pay When You File: TurboTax online and mobile pricing is based on your tax situation and varies by product. Both offer free versions, though TurboTax's is more robust and offers more credits. TaxSlayer and TurboTax also both offer free filing for military members. Both offer free versions, though TurboTax's is more robust and offers more credits. TaxSlayer and TurboTax also both offer free filing for military members. TurboTax Versions for Online Use · The first version is the Basic one, which is ideal for simple tax filing needs and includes e-filing. · The second version is. by TurboTax• Updated 1 month ago · Annual Audit Defense—Audits can be random. · Full Identity Restoration—If you experience personal identity fraud, a dedicated. Investment sales and rental property have been moved up to the highest tier, and the prices for the paid products have gone up by $ The Free Edition (federal. TurboTax and TaxAct both offer a similar slate of products and services for tax filing, including a free option and several paid tiers for online and desktop. Jumpstart your taxes with last year's tax return, snap a photo of your W-2, answer basic questions about your life, and get your maximum refund, guaranteed. You can't switch if you already paid with a credit card or had your TurboTax fees deducted from your refund ; Note: TurboTax Free Edition is for customers who. Those with additional Schedules to complete outside Schedule 1 or with forms will need a paid edition of TurboTax. TurboTax Basic price: TurboTax Online. When figuring an education credit, use only the amounts you paid and are deemed to have paid during the tax year for qualified education expenses. In most cases. TurboTax has tricked military service members to pay to use the filing software by creating and promoting a "military discount" and by making the free version. Free vs. paid tax services: When to plan on paying for an upgrade. Filing refund or tax liability, plus cover any legal or audit costs up to $, File Your Tax Return With TurboTax For Free With TurboTax Free Edition. 37% of taxpayers qualify. Form + limited credits only. You'll pay absolutely. refund compared to other competitors. Hannah. California, CA. This program was WAY easier than Turbo Tax and H&R Block, plus it asked questions that both. For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to. E-file your federal and state taxes online with TaxAct. Explore tax products for a wide range of tax filing situations and get your maximum tax refund.